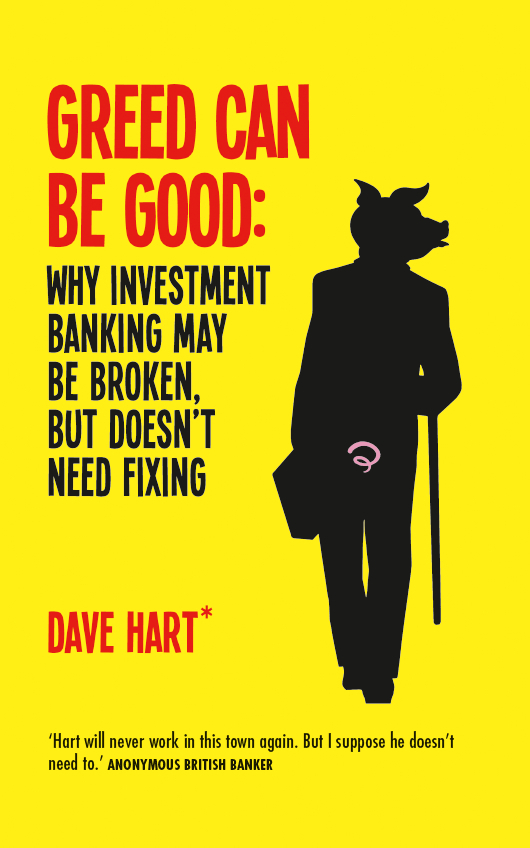

Greed Can Be Good: Why Investment Banking May Be Broken But Doesn't Need Fixing

By: David Charters

As an investment banker I witnessed at close hand the most expensive financial crisis in modern history. The result of decades of artificially inflated prices, a bonus culure based on the ‘me now, and I want it all’, and torrents of cheap money that we thought would last forever. I was paid millions – in some years, tens of millions. But did it make me happy?

Of course it did. I loved any minute of it. Money isn’t guaranteed to buy you happiness, but it sure helps. We had a hell of a party, and rest of the world had our hangover. But was it right?

This book is an exploration of what we did and why we did it and most importantly, where we go next. It is not a chest-beating polemic from a former banker on a guilt trip. I don’t do guilt, and anyway I’m not guilty.

Do we need a new code of ethics? A different approach to the way we do business? Or should we just repackage the old one and carry on? There are no definitive answers and clearly no easy ones for an industry used to getting its own way. All I can offer is the insight of an insider and my reflections for the future. Plus my assurance that whatever happens, bankers will still come out on top.

We always do.

Dave Hart

-

Fast and furious with enough laughs to keep you from worrying if what Mr. Charters says is actually true.

- Christopher Reich, author, Rules of Deception on Trust Me, I'm a Banker